京極シャンプー(kgシャンプー)はドン・キホーテで買える?安いのはココ!

京極シャンプー(kgシャンプー)はドン・キホーテ(ドンキ)で買える?1番安いのは?

最近流行りのカラーシャンプーですが、特にムラシャン(紫シャンプー)を使ってみたいと思いました。

せっかくなら口コミがいい、京極シャンプーを使ってみたいかも。京極シャンプーってドンキで買えるかしら?

あまり見かけたことがなかった京極シャンプー。

京極シャンプーはドンキやドラッグストア、薬局、ロフト、東急ハンズで買える?

公式ならタイムセールもあるってほんて?京極琉のアイテムをお得に手に入れる方法をリサーチしてみました。

京極シャンプーはドンキでは買えない

最初に結論からまとめておきます。

- 京極シャンプーはドンキでは買えない。

- ロフト、東急ハンズ、一般的な薬局やドラッグストアなどの店舗にもなし。

- Amazonや楽天、ヤフーショッピングでも買えるけど、公式が安い。

- 通販の公式サイトなら、各種京極琉のアイテムを買えて、タイムセールで安く買えることも。

京極シャンプーはズバリ、公式サイトからの購入が1番お得です。

すぐに最新のタイムセールが見たい!という場合は・・・

詳しく解説が見たい方は、続けで読んでみてください♪

kgシャンプーを店舗で探してみた結果

ドンキだけでなく、ロフトや東急ハンズ、薬局やドラッグストアで探してみました。結果は・・・?

| ドンキ | × | ロフト | × |

| 東急ハンズ | × | PLAZA | × |

| ツルハドラッグ | × | ウエルシア薬局 | × |

| スギ薬局 | × | サンドラッグ | × |

| マツキヨ | × | ココカラファイン | × |

いずれの店舗でも、京極シャンプーは見つからず。

他のムラシャンはいくつか見かけたのですが、京極琉ブルーパープルシャンプーが欲しいときは通販から購入する必要があります。

京極シャンプーは公式サイトが安い

京極シャンプーが買えるのは、公式サイトになります。

公式サイトでは単品もありますが、お得なセットやタイムセール、ギフトカードやポイントも用意されています。

京極シャンプーは具体的にいくら?

| KYOGOKUブルーパープルカラーシャンプー | 3267円 |

| KYOGOKUピンクパープルカラーシャンプー | 3267円 |

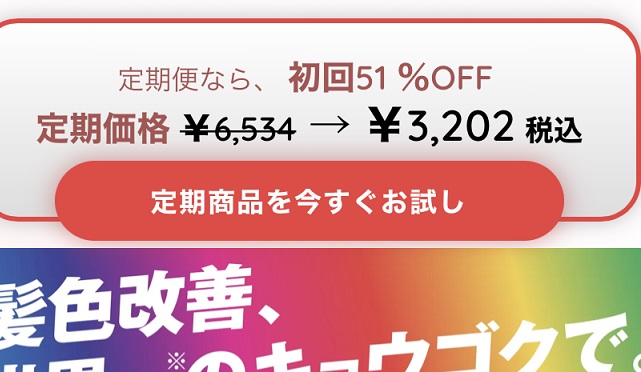

| カラーシャンプー+京極トリートメント | 3202円 |

単品で買える京極シャンプーですが、今ならトリートメントとのセットがお得です。

むしろムラシャン(ブルーパープルカラーシャンプー)単品より安いですね。

場所はブルーパープルカラーシャンプーのページの「定期商品を今すぐお試し」を選ぶと、セットのページに移動するので、気になる方はチェックしてみましょう。

また、新規会員登録をすると1000ポイントもらえるので、最初に会員登録もするとなお安くなります。

タイムセールも公式のみ

タイムセールを確認してみました(2022/12月時点)。

| セット内容 | 値段 |

| KYOGOKU パーソナルカラーシャンプー ダークグレージュ ブルベ冬 + マジックフォーム | |

| 選べるカラーシャンプー+カラーケアトリートメント+ケラチントリートメント+ブラックダイヤモンド+ケラチンブースト+シグネチャーオイル | |

| カラーシャンプー5種&ブラックダイヤモンド&スパークリングオイル2個買うと1個プレゼント | |

| CBDオイル3種各1個・CBDフルーツグミ2個・アイソレート・水溶性アイソレート・CBDナチュラルオイル・CBDブースト3個・アップルグミ4個 | |

| 1万円以上のお買い上げの方へ全員プレゼント CBDオイル |

タイムセールの中には、なんと50%〜70%オフのセットもあります。

数量限定ということで、既に売り切れている内容もちらほら。カラーシャンプーが対象のものもありますね。

欲しいタイムセール内容があったら、早めに購入したいと思います♪

おすすめランキングから選ぶのもあり

公式ではおすすめランキングも掲載されているので、今現在売れている人気商品を確認することができます。

今現在(2022年12月)のランキングを紹介すると、

| 1位 | KYOGOKU ブルーパープルカラーシャンプー |

| 2位 | KYOGOKU ギフトカード1万円分 |

| 3位 | KYOGOKU ケラチンブースト+トリートメント (髪質改善パウダー)3g |

| 4位 | 福袋ベーシックセット(選べるカラーシャンプー+カラーケアトリートメント+ケラチントリートメント+ブラックダイヤモンド+ケラチンブースト+シグネチャーオイル) |

| 5位 | KYOGOKU ブラックダイヤモンド 180g |

(※ランキングは随時更新されます)

ちなみに2位のギフトカードは、自分でも使うことができます。

9000円で1万円分のお買い物ができるので、公式なら常に実質1割引。さらにポイントももらえます。

9000円〜お買い物するときは、ぜひギフトカードを活用してみましょう。

1位は大定番の「KYOGOKUブルーパープルカラーシャンプー」ですね。

やはり人気があることを確認できます。

さて、京極シャンプーは公式が安い!と紹介してきましたが、本当に安いのか?気になる方は続けてチェックしてみてください。

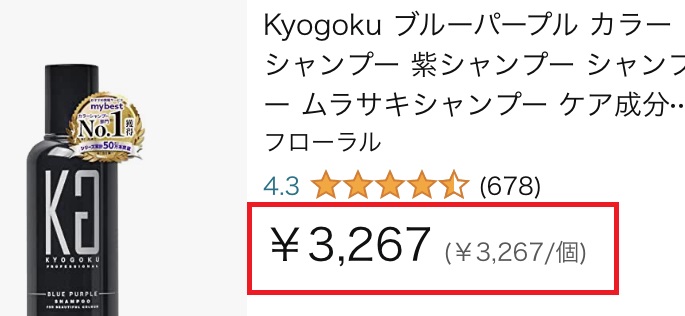

京極シャンプーはAmazonや楽天ではいくら?

Amazonや楽天、ヤフーショッピングなどで、「京極シャンプー」を検索して調べてみました。

| Amazon |  |

| 楽天 |  |

| ヤフーショッピング |  |

Amazonでは公式の京極シャンプー単品と同じ値段になっています。

ただし、公式ではカラートリートメントのセットやタイムセール、ギフトカード、会員ポイントなどのお得要素もあるので、基本的には公式サイトからがおススメですね。

また、楽天やヤフーショッピングでは値段も高いため、やはり公式からが推奨です。

京極シャンプーの口コミ!メリットとデメリット

京極シャンプーの口コミから、メリットとデメリットをまとめてみました。

口コミはブルーパープルカラーシャンプーのものです。

悪い口コミもある?デメリットは?

全体的には口コミも良い京極シャンプーですが、髪質によっては合わない・・・という口コミもありました。

京極シャンプーというよりは、シャンプーやトリートメント全般に言える内容かなと思います。

髪質や髪の状態、傷み具合などは個人差もあるため、感じ方に差も出るようです。

もう一つが値段が高いという内容でした。

確かにドンキやドラッグストアなど、市販の店舗にはもっと安いカラーシャンプーもあるので、デメリットと言えます。

とは言え、高い品質と1本6役を果たしてくれる京極シャンプーなので、特別コスパが悪いとは感じない値段ですね。

少し高めだけど、良いムラシャンを使ってみたい!という方向けです。

公式のギフトカードやポイントを利用して、出来るだけお得に手に入れましょう。

良い口コミ!京極シャンプーのメリット

良い口コミで特に目立った内容は、綺麗に染まるのにシャンプー後の髪のコンディションが良い、というところです。

1本で6役ある京極シャンプーなので、カラーだけでなく髪や頭皮のケアもしてくれます。

他にも、

- シャンプーだけでいいから時短になる

- 定期的に使うから、染まった状態をキープ

- 泡立ちが良くしっかり洗える

- いつでも家で簡単にできる

- 香りも良い

などなど。

さらに口コミを見たい!という方は、公式サイトにも口コミが投稿されているので、確認してみると良いですよ♪

まとめ ドンキホーテにはないkgシャンプーを安く買うコツ

ドン・キホーテにはない京極シャンプー。公式サイトで安く買うには、

- 京極トリートメントとの定期を利用してみる(送料も無料に)

- タイムセールをチェックする

- 新規会員登録をすると1000ポイントもらえる

- ギフトカードを買うと、9000円で1万円分買える

- >>京極公式ページはこちら

京極琉公式サイトでは、以上のようなお得要素もいくつか用意されているので、できれば利用しながら購入してみると安く買えます。

京極シャンプーが気になってる方は、公式サイトをチェックしてみましょう。

京極シャンプーに偽物はある?追記

京極シャンプーに偽物がある?という噂も聞いて、調べてみました。

メーカーのKYOGOKUさんから販売されている商品に、偽物・類似品もあるという話なので、京極シャンプーにも偽物がある可能性があります。

KGロゴが使われている場合もあるとのことですので、販売店には気をつけた方が無難です。

偽物対策としても、やはり公式サイトからの購入が間違いないと言えますね。

京極シャンプーの解約やマイページについて

京極シャンプーの解約やマイページについて、追記しておきます。

京極シャンプーを定期購入する場合のみ、ストップするときに解約手続きが必要です。

トリートメントとの定期購入が半額以下ととても安いので、私も選びたいセットですから。

定期購入の解約はマイページから

京極シャンプー&トリートメント定期購入の解約は、マイページからできます。

- まずは京極琉公式ページから、マイページへログイン。

- マイページから定期一覧を選び、詳細を見るを選ぶ。

- 解約手続きをする。

という手順です。

ちなみに継続の約束などは特にないので、デメリットもなく安くなるだけですね。

京極シャンプー単品で購入するより安くなる、トリートメントとのセットです。

上手く活用して、お得に京極シャンプーを手に入れましょう。